My First Month Reselling: Profit, Loss, and What I Learned

Starting something new can be exciting—and intimidating—especially when it comes to money. Today, I’m breaking down my first full month of reselling, including profits, losses, startup expenses, and mistakes, so you can see what this actually looks like in real life—not just highlight reels from experienced resellers.

I think transparency is incredibly important, especially for beginners. You often see seasoned resellers sharing big numbers, but not many people talk about what that first month really looks like once you factor in startup costs and learning curves.

This blog contains affiliate links. As an Amazon Associate and affiliate, I will make a small commission on purchases made from links in this blog.

A Little Context About Me

To understand these numbers, it helps to know what my situation looks like.

I’m a stay-at-home mom of three kids under four. My husband is currently deployed, so most of the sourcing, listing, and shipping is done by me—often in short pockets of time between naps, meals, and general chaos.

Before becoming a stay-at-home mom, I worked in finance as a CPA and previously owned a brick-and-mortar retail store selling refinished furniture and artisan goods. That experience gave me a solid understanding of business basics, but I’ll say this clearly:

Reselling from home is far less stressful and time-consuming than owning a physical store.

I would never own a brick-and-mortar again. While it can be rewarding, it’s also incredibly demanding.

Why I Started Reselling

My goal with reselling is simple:

Make a little extra income for my family

Build savings

Fund small house projects

Like many families right now, we’re feeling the strain of the economy and looking for ways to bring in additional income without sacrificing time with our kids.

Platforms I’m Selling On

During my first month, I sold primarily on:

eBay

Depop

I’ve also recently started cross-listing on Poshmark, though I don’t expect it to become my main platform. If it brings in extra sales, great—but it’s not my primary focus.

What Sold in My First Month (With Real Numbers)

Below is a breakdown of each item that sold, including purchase price, platform, fees, and profit.

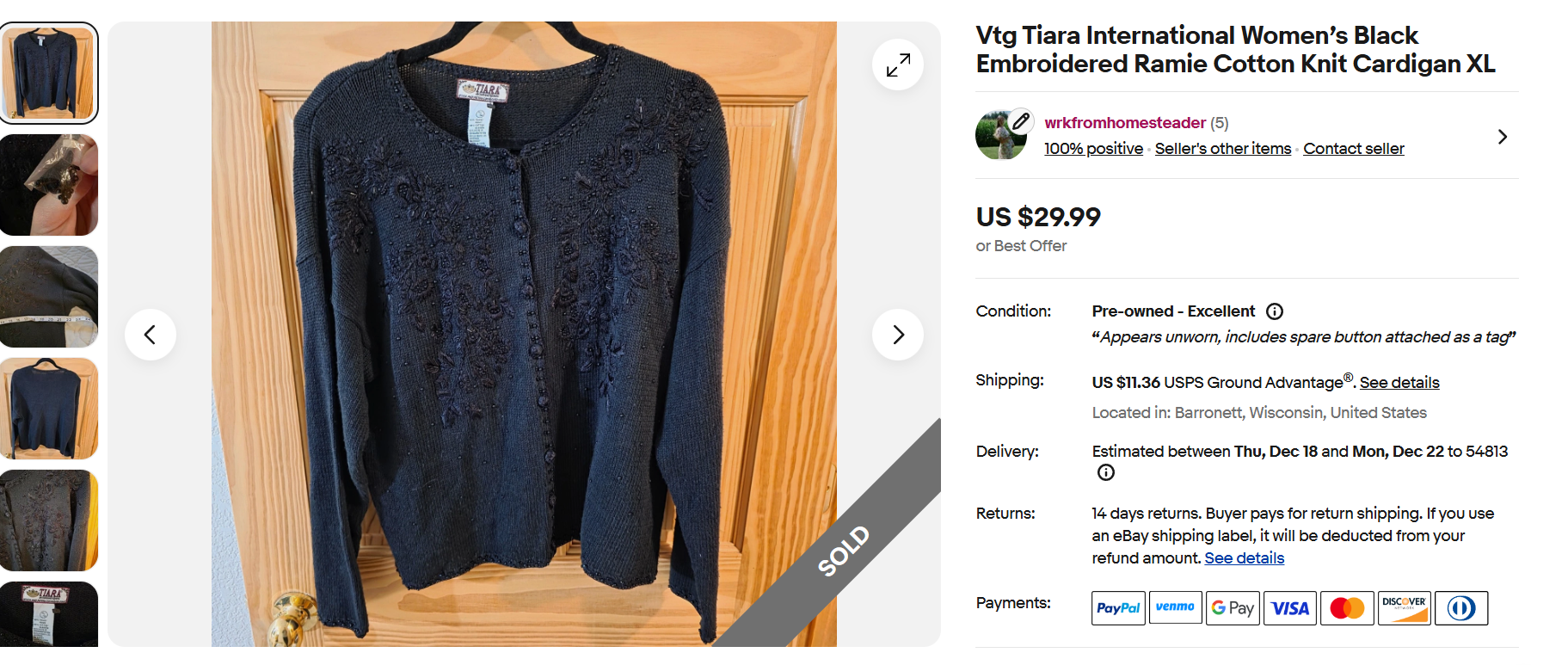

1. Vintage Tiara International Sequin Sweater (eBay)

Purchase price: $5.59

Sale price: $29.99

Fees: $6.69

Profit: $17.70

This sold the same day I listed it, which was incredibly motivating as a beginner.

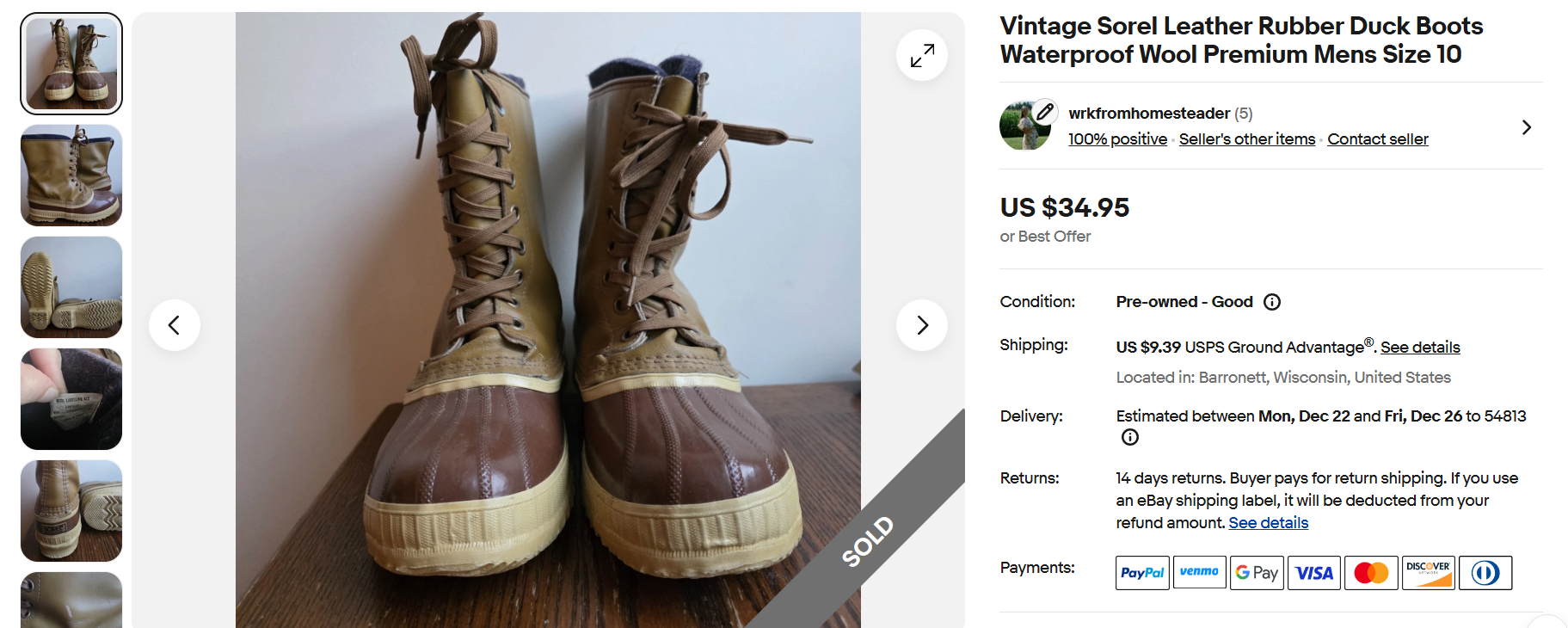

2. Vintage Rubber Duck Boots (eBay)

Purchase price: ~$5 (originally bought for myself)

Sale price: $34.99

Fees: $6.63

Profit: $28.36

These were headed for donation, so this felt like found money.

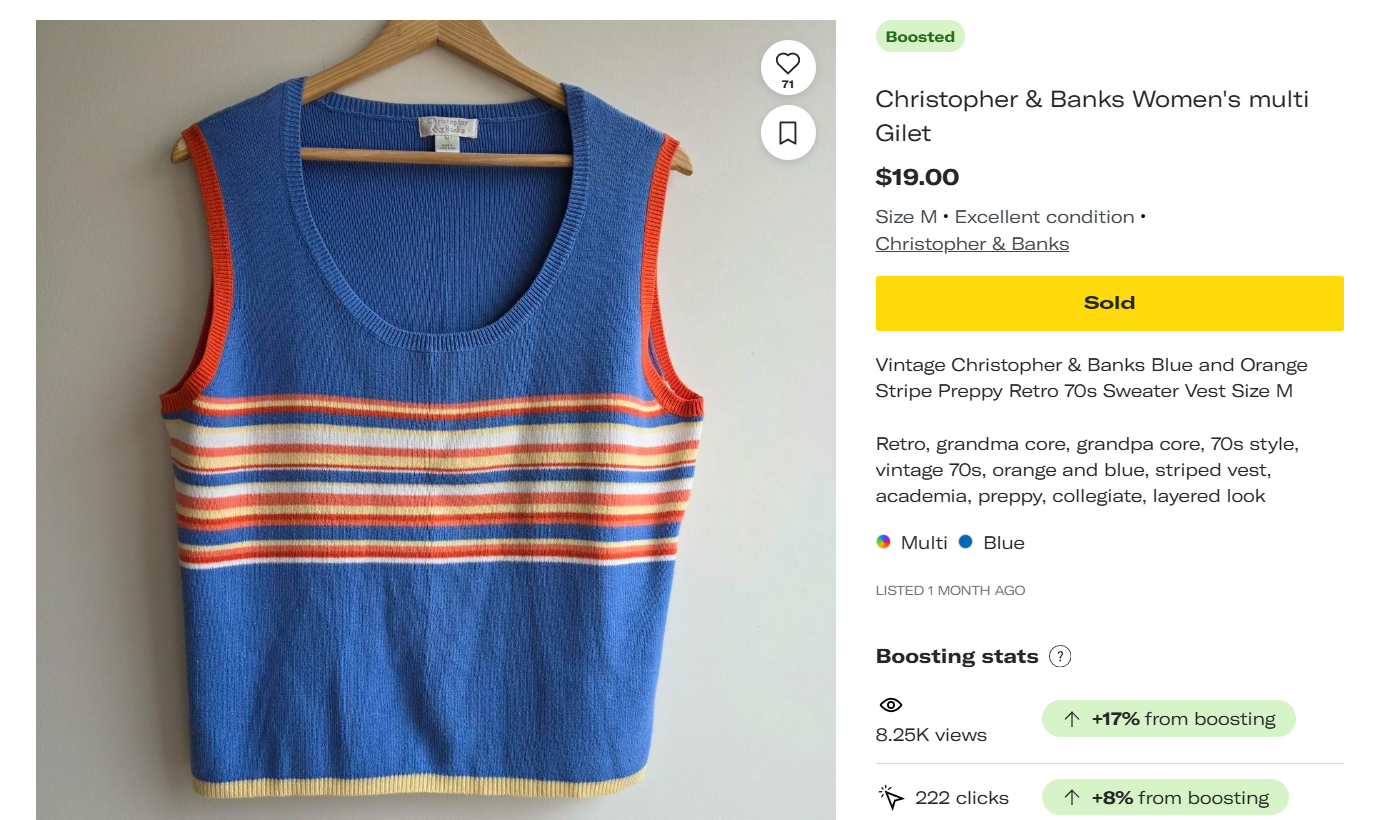

3. Christopher & Banks Vintage Sweater (Depop)

Purchase price: $3

Sale price: $16

Fees: $1.24

Profit: $14.76

This showed me how powerful lower platform fees can be.

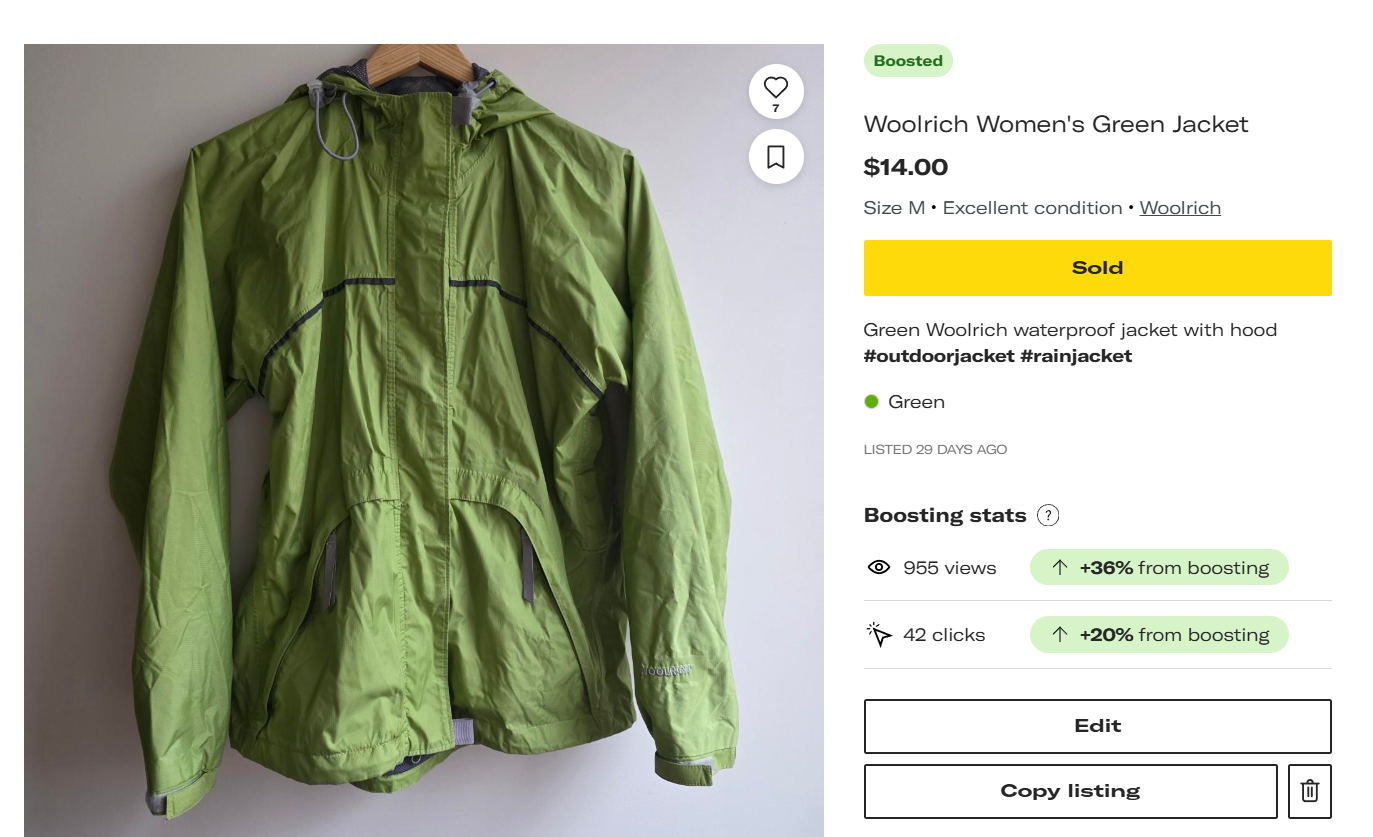

4. Woolrich Women’s Windbreaker (Depop)

Purchase price: ~$2 (bins)

Sale price: $11

Fees: $2.06

Profit: $8.94

A quick flip with minimal effort.

5. Fashion Bug Cable Knit Tunic Sweater (Depop)

Purchase price: $5

Sale price: $19

Fees: $1.63

Profit: $11.76

This was a quick flip and an easy sale!

6. “It’s a Wonderful Life” Snow Globe (eBay)

Purchase price: $0 (part of a lot I bought for myself)

Sale price: $84

Fees: $14.07

Profit: ~$70

This sale completely changed how I think about hard goods and estate sales.

7. L.L. Bean Cable Knit Cardigan (eBay)

Purchase price: $0 (from my own closet)

Sale price: $25.99

Fees: $5.71

Profit: $20.28

Total Profit on Items Sold

Total profit (after fees & cost of goods): $168

Startup Investments (And Whether They Were Worth It)

Here’s where many beginners get surprised.

Worth It for Me

Thermal printer – Necessary with three young kids and living far from the post office

Shipping scale – Essential for shipping from home

Poly mailers – Absolutely required

Maybe Not Right Away

Resealable plastic bags (I would order bigger ones next time)

These weren’t bad purchases—but they weren’t necessary in month one.

Final Numbers: Profit or Loss?

Gross revenue: $220.97

Inventory cash investment: $107

Platform fees: $38.03

Startup supplies: $105.85

Education (Reseller’s Edge group): $25

Final Result:

Cash flow loss: $54

Operationally profitable (no item sold at a loss)

If you remove startup investments, this would have been about $50 positive cash flow for a normal month.

Inventory Still to Sell

I still have roughly $1,000 worth of listed inventory. Even if pricing is reduced by 30%, that’s around $700 in potential future sales, which tells me this business is scalable and profitable long term.

Final Thoughts: Was It Worth It?

Yes—absolutely.

I made $177 on sold items, learned valuable lessons, and built infrastructure that I won’t need to rebuy next month. For something I do in small pockets of time as a stay-at-home mom, this feels like a solid return.

You can start reselling cheaper than I did:

No thermal printer

No scale

Use the post office if it’s close

For me, those investments made sense—and I can always resell the equipment later.

What’s Next?

I plan to:

Continue listing consistently

Explore estate sales and hard goods selectively

Share a December income report

If you’ve tried reselling, I’d love to hear:

What worked for you?

What you want to learn next?

Thanks so much for reading, and I’ll see you in the next update.